Today, let’s dive into the latest trends in Clean Tech and Energy Innovation.

2024 presented a dynamic landscape for clean technology and energy innovation. Despite headwinds, the sector showed resilience and continued growth in key areas. Looking ahead to 2025, rising energy demands, geopolitical tensions, and policy shifts are poised to shape the industry’s next chapter.

2024: A Year in Review

Macro Highlights:

- Investment Stagnation: 2024 was challenging for US climate tech venture and growth investments, which remained flat at $14 billion, the same level as 2023. This stagnation mirrored the global trend, which saw a 14% decrease from 2023. Investor caution stemmed from political uncertainty, fluctuating oil prices, and high interest rates.

- Sector Maturation & Exits: Despite slower investments, the climate tech sector showed signs of maturation. The number of exits (acquisitions, IPOs, SPACs) in the US nearly doubled compared to 2023, indicating sector maturity. Globally, the graduation rate of climate tech startups more than doubled.

- Shifting Investment Focus: Energy overtook transportation as the most funded sector in 2024, capturing 39% of total US investments ($5.4 billion), driven significantly by the electricity demands of Artificial Intelligence (AI). Transportation investments decreased globally, though it remained a major sector. Investments in the industry sector also saw a notable drop in the US.

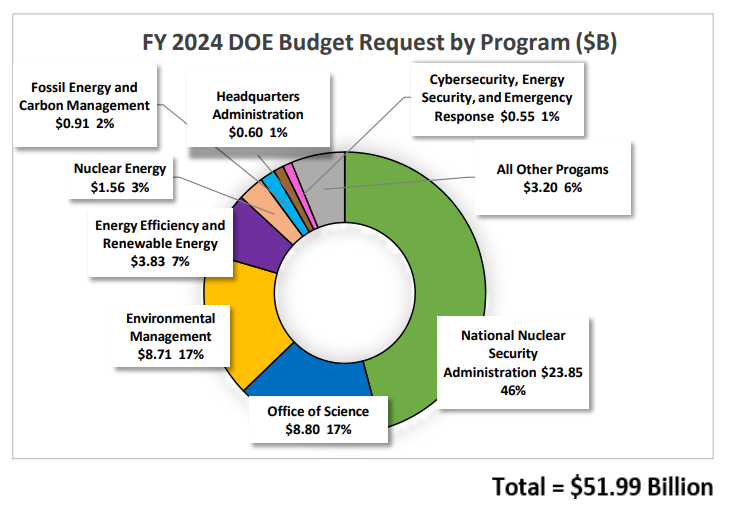

- Policy & Public Funding: US public investments prioritized clean energy manufacturing, grid improvements, nuclear energy, industry decarbonization, and electric vehicle (EV) charging infrastructure. Significant funding was allocated through programs like the Inflation Reduction Act (IRA) and CHIPS Act, aiming to bolster domestic capabilities and accelerate clean energy deployment.

- Rising Electricity Rates: Inflation and the costs associated with maintaining an aging grid continued to push US electricity rates upward. California utilities, for example, saw significant rate increases over the past few years.

Emerging Trends:

- AI’s Influence: Generative AI capabilities grew exponentially, sparking interest across sectors despite concerns about its high electricity demand. The demand for clean, firm power for AI data centers drove investments towards nuclear and geothermal energy. Nuclear funding nearly doubled, and geothermal funding increased sevenfold in the US.

- Nuclear Renaissance: Nuclear power gained momentum, supported by government pledges (like the goal to triple global capacity by 2050) and initiatives like the Vogtle plant completion and potential reactor restarts. Tech companies also showed growing interest in nuclear power.

- Grid Modernization & Challenges: Utilities invested heavily in grid adaptation, hardening, and resilience, including distributed energy resources (DERs) and microgrids. However, transmission remained a bottleneck due to siting and permitting challenges, despite federal initiatives.

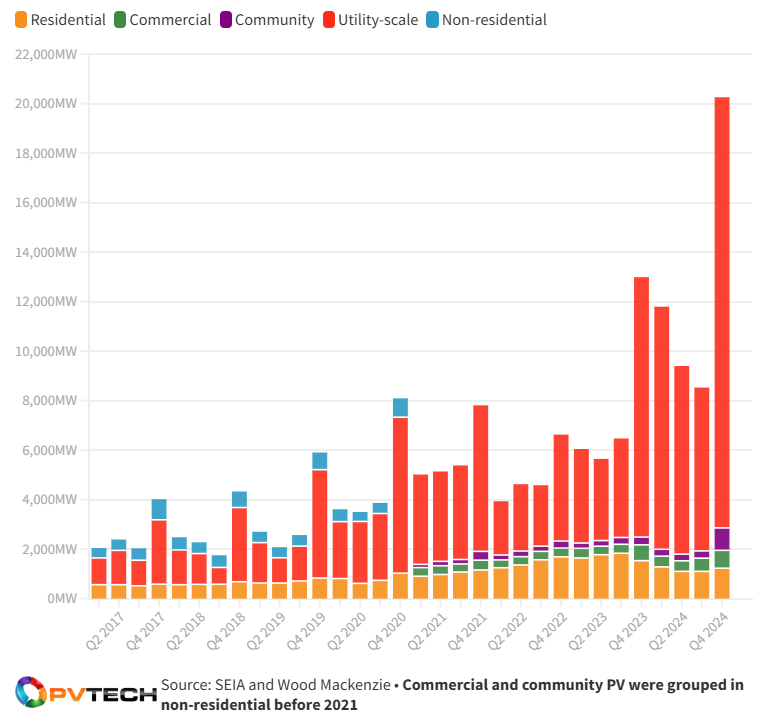

- Solar Dominance: Solar energy installations exceeded expectations, accounting for 66% of new US grid capacity in 2024. Growth was supported by falling battery storage costs, advancements in thermal storage, and IRA tax credits, which also boosted domestic module manufacturing.

- Electrification Momentum: EV sales continued to grow (+7% year-over-year), albeit slower than expected. Building electrification and smart home systems saw steady growth, boosted by IRA incentives, although heat pumps had a tough beginning of the year.

- Other Hot Topics: Energy storage installations grew significantly (+33%), driven by grid-scale projects and falling battery prices. Sustainable Aviation Fuels (SAF) saw a dramatic increase in US production capacity. Carbon Capture and Storage (CCS) also gained traction, with major projects announced and significant DOE funding allocated.

2025 Predictions: Navigating Uncertainty and Demand

Macro Highlights:

- Political & Policy Uncertainty: The election outcome introduces very significant uncertainty. Potential policy shifts under the Trump administration could impact renewable energy support, favor fossil fuels (“drill baby drill”) and nuclear energy, affect supply chains (especially on solar and batteries), and potentially alter IRA provisions. Key campaign pillars like potential tax cut extensions (possibly paid for by IRA cuts), new tariffs impacting manufacturing inputs and potentially sparking retaliatory actions, and immigration policy affecting labor availability could all indirectly influence the climate tech sector. Government spending and support in climate tech, such as loans and grants, will likely see an overall reduction. However, the Inflation Reduction Act (IRA) includes significant clean tech investments and manufacturing tax credits that currently mostly benefit Republican and swing states. Because of this, and as many Republican deputies have reportedly urged caution, these IRA provisions might moderate some potential rollbacks in government support.

- Geopolitical Impacts: US-China relations will heavily influence the climate tech sector, particularly solar and EV supply chains. A continued deterioration in relations could severely impede the progress of clean energy adoption, particularly in the US, given China’s current dominance in critical mineral processing and the manufacturing of key components like batteries and solar panels. This could lead to higher costs, supply chain vulnerabilities, and delays in the transition to electric vehicles and renewable energy sources. Several scenarios are in play: could increased competition spur innovation and accelerate the development of alternative supply chains in the US (even though the gap with China remains difficult to close)? Or will the US risk isolating itself and doubling down on fossil fuels (a potentially risky bet given the need for diversification)? Could China gain new global influence through its dominance in climate tech (but where would that leave Europe)? Might this moment catalyze a nuclear renaissance (but what would that mean for the future of renewables)?

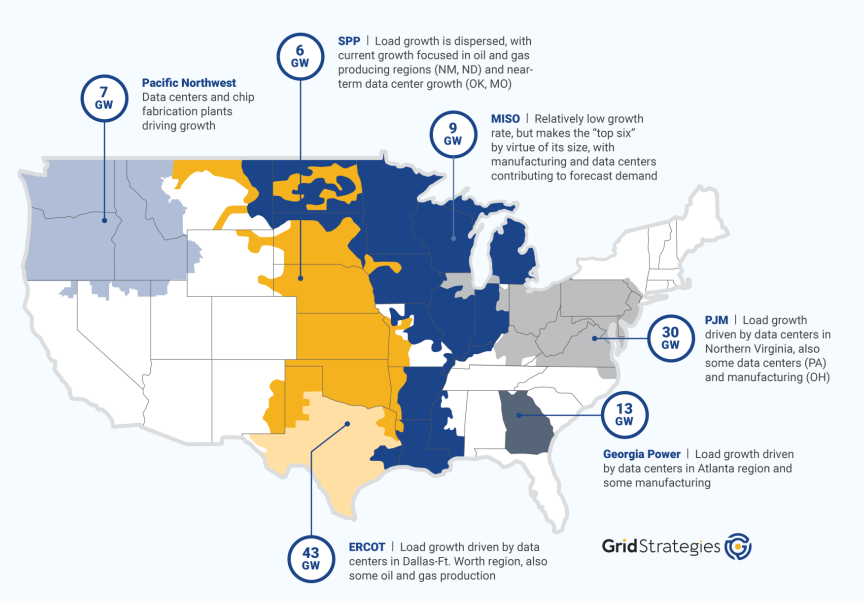

- Surging Data Center Demand: The electricity demand from data centers, fueled by AI, is projected to surge, potentially consuming 6.7% to 12% of total US electricity by 2028. This poses significant challenges to grid stability and reliability, pressuring utilities and grid operators.

- Grid Strain & Market Reforms: While transmission expansion remains a priority, it will likely be insufficient to meet demand. Grid operators are expected to implement market reforms to manage supply/demand dynamics and address interconnection queues, but questions remain around the timing of implementation and their effectiveness.

- Oil, Gas & LNG Focus: Increased support for fossil fuels is expected, leading to growth in oil and gas production and liquefied natural gas (LNG) exports. This, along with rising electricity demand, could push natural gas prices upward

- Continued Rise in Electricity Prices: Factors like supply chain issues, grid investments, and rising natural gas prices are expected to continue driving up wholesale and retail electricity prices in most US regions.

- Stable Investment & Exits: Despite uncertainties, venture capital and growth funding levels in climate tech are expected to remain relatively stable, with infrastructure funds potentially increasing their role. The strong exit rate seen in 2024 is also anticipated to continue.

Expected Trends:

- Generative AI Advancements: AI innovation will continue, focusing on AI Agents, Small Language Models for on-device integration, AI for cybersecurity, and Physical AI/Robotics. This could open a new world of possibilities, but many breakthrough capabilities will likely be seen later than 2025 .

- Nuclear & Geothermal Growth: Driven by surging data center demand and favorable policies, both nuclear (including small modular reactors (SMR) and potential reactor restarts) and geothermal energy (especially Enhanced Geothermal Systems) are poised for continued growth and investment. Nuclear, in particular, will be a key sector to watch in 2025, with expected regulatory progress potentially streamlining deployment, and rising corporate demand opening up new business opportunities.

- Grid Resilience Technologies: Increasing extreme weather events and data center demand will heighten the focus on grid hardening and resilience. Smart grid technologies, virtual power plants (VPP), DERs, and microgrids should receive a lot of attention

- Carbon Management Takes Center Stage: With increased fossil fuel activity and strong potential for the oil industry, Carbon Capture – especially Direct Air capture (DAC), Utilization, and Storage will become crucial. Consequently, blue hydrogen may also gain focus over green hydrogen. Carbon removal and offset markets are also expected to grow.

- Solar & Storage Resilience: Despite potential tariff impacts and policy headwinds, solar growth is expected to continue, driven by ongoing load growth, falling manufacturing technology costs, and new complementary technologies currently in development. Battery storage, including long-duration options, will remain critical for grid integration. Interconnection challenges persist, but attempts to address them will be looked at.

- Electrification Under Pressure: While regulatory changes (loss of tax credits, tariffs) will impact EV and building electrification growth, sector resilience, falling battery costs, and private investments may mitigate the effects.

The clean tech and energy landscape is entering a period shaped by technological acceleration (particularly AI), significant demand growth (data centers), and policy adjustments coupled with high uncertainty. While challenges exist and while the new Trump administration may make it hard to forecast outcomes and scale certain industries, innovation across various clean tech sectors continues. The growing alignment between climate goals and economic opportunity remains a powerful tailwind for the energy transition.

Key insights and data for this article were drawn from reports by Energy Impact Partners, Sightline Climate, Utility Dive, the DOE, and EIA as well as other relevant sources

Garance Martin, Open Innovation Analyst